CCG Investment Strategies

Tailored investment strategies designed to maximize returns and build wealth through smart, data-driven real estate opportunities—Countrywide Capital Group delivers unmatched results.

Short-Term & Long-Term Investment Opportunities

Countrywide Capital Group specializes in small to medium-sized projects with shorter timeframes and limited risk. We focus on value-add and ground-up construction projects where we can rapidly increase property value and enhance profitability under any market conditions. With low minimum investment amounts and flexible timeframes, you can diversify your real estate portfolio by spreading investments across multiple projects. Currently, all projects are available on a deal-by-deal basis, offered on a first-come, first-served basis. Investors receive an equity ownership stake in each deal.

QOZ Investments

Tax Savings + High Growth

- Opportunity Zone

- 28.4 increase in return

- Renovate-convert-sell

What Countrywide Capital Does for Investors

Gatsby handles every detail of the real estate investment from start to finish.

Site Selection

Conducting Market Research

Evaluating Potential Deals

Establishing and Managing LLCs

Managing Purchase Escrow

Creating the Investment Offering on the Website

Obtaining the Loan

Securing the Necessary City Permits

Renovating or Constructing the Structure

Overseeing the Construction Team

Achieving Property Stabilization

Overseeing property management for rental properties

Property marketing and sales

Providing project updates to investors

Managing financials, accounting, and Schedule K-1 filings

Ensuring timely payments to investors

Why Real Estate?

Diversifying your portfolio with real estate investments through Countrywide Capital is an excellent way to balance risk and reward. Real estate has historically delivered above-average returns, and since it’s backed by a tangible asset, it’s less vulnerable to the market uncertainties that often impact stock prices. Unlike other asset classes, real estate also provides a reliable hedge against inflation.

Countrywide Capital's unique investment strategy.

Most fund companies focus on the large deals that make up 30% of the market because managing and developing multiple smaller projects simultaneously is challenging. Many companies are not structured to handle the volume of projects, as each one requires extensive due diligence and significant administrative effort, resulting in higher overhead costs. As a result, funds with substantial capital often target fewer, larger projects, missing out on many lucrative opportunities.

Countrywide Capital recognized the potential in targeting the remaining 70% of the real estate market and found a way to manage small to mid-sized investment projects at scale, making them accessible to investors.

By streamlining the process with our proprietary software, we can automate workflow tasks such as proforma calculations, online investment offerings, construction management, and tax filings, while keeping overhead costs low. This enables us to deliver higher returns to investors.

Additionally, by partnering with established developers and operators across various markets in the US, we offer deal flow, diversification, and unique investment opportunities to fund companies.

Reasons for funds to invest with Us

There are several reasons why it makes good sense for funds to invest in Countrywide Capital real estate projects, including:

Fund diversification

Fund diversification

Funds can invest with Countrywide Capital as a way to diversify their portfolio. Perhaps your fund currently lacks real property holdings and you want to allocate a portion of it to capitalize on the real estate market. Or maybe you’re already investing in real estate, but your fund is too heavily focused on commercial properties, and you’d like to add residential investments. Alternatively, you might have too many long-term holdings and wish to incorporate some short-term real estate projects. In each case, you can invest a percentage of your fund with Countrywide Capital to easily increase your real estate exposure.

With Countrywide Capital’s flexible offerings, you can choose from value-add projects, ground-up developments, and multi-family rentals, each of which can help you build a more balanced fund portfolio.

Short-term real estate investments

Short-term real estate investments

Our short-term real estate investment projects offer unique benefits for fund investors.

These short-term options include house flips and smaller multi-family developments, with hold periods ranging from 6-24 months. They provide an excellent opportunity for funds seeking more liquid investment options.

For example, let’s say your fund has raised the capital needed for your next investment project, but you won’t need all the funds immediately. Instead of leaving the money uninvested, you can allocate it to short-term options with Countrywide Capital. This strategy allows you to grow the capital in the short term and have it returned to the fund by the time you need it.

Put your overfunding to work

Put your overfunding to work

After raising capital for your investment fund, you may find that you have more funds than needed for your project. With excess cash on hand, you want to put this money to work for your investors, but it might not be enough to purchase a new property. Instead of letting that capital sit in a low-return account, you can invest it with Countrywide Capital to generate higher returns for your investors.

With our low minimum investment amounts, you have an easy and accessible way to put extra capital to work efficiently.

Countrywide track record of success

Countrywide track record of success

From 2017 through 2023, Countrywide Capital’s developments have delivered an average annualized net return of 23.0% to investors. We consistently find ways to generate strong returns, regardless of market conditions. Plus, we have never had a deal fail to turn a profit!

Investment types

There are distinct investment types offered by fund companies:

Funds can choose between equity or debt investments. With an equity investment, you obtain an ownership interest in the underlying real estate. In contrast, with a debt investment, you act as a lender to the deal.

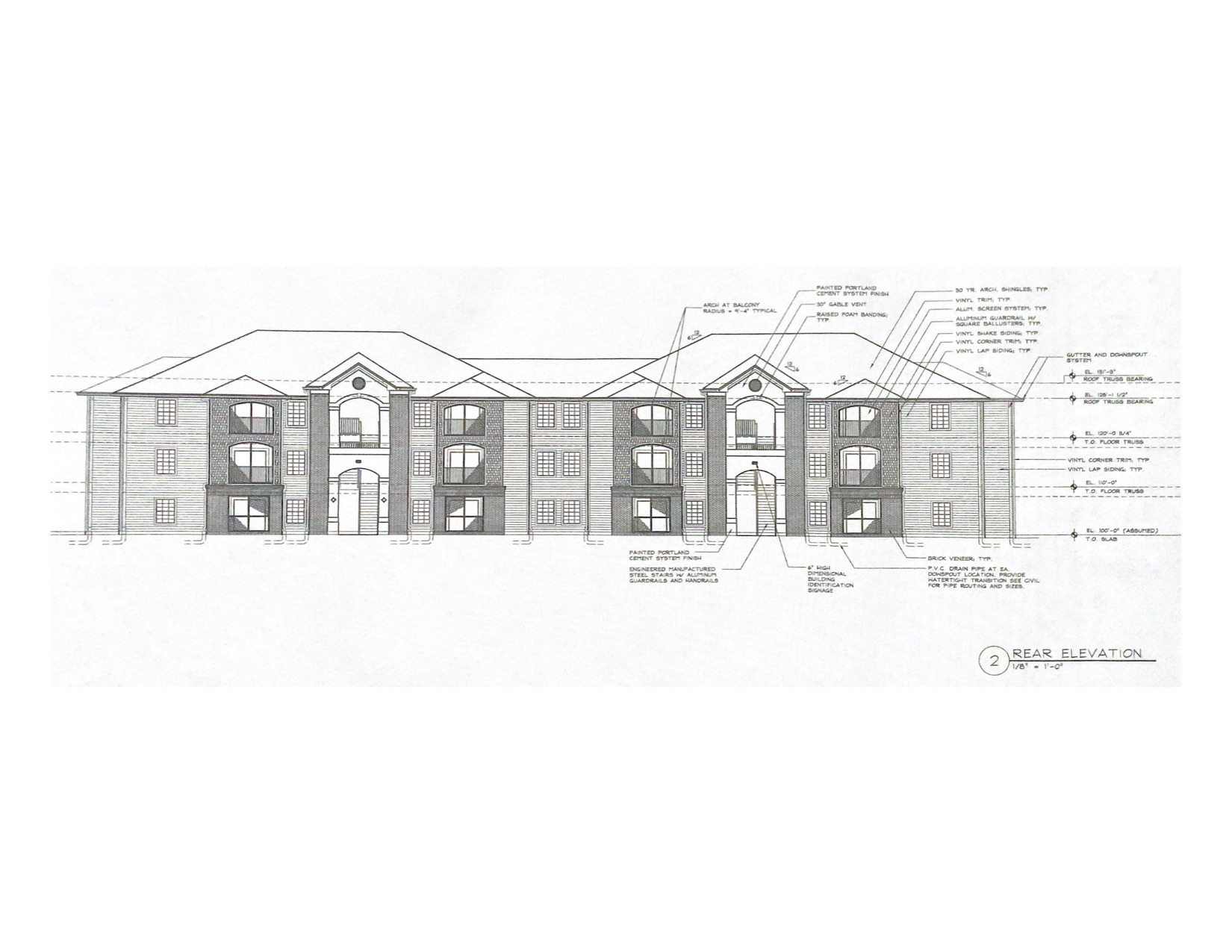

Multi-Family Lake Willie Village

These Lake willie village investments are designed for resale and can be completed within 2 years, offering an estimated target return of 17%-20% for equity investors.

Magnolia Landing

Magnolia Park is a rare opportunity to invest in a high-demand, high-profit senior living community in one of Florida’s fastest-growing regions. With zoning, utilities, and PACE funding already in place, this development is positioned for efficient execution and significant returns.

Belleview Heights

These opportunistic developments are designed for resale and can be completed within 14-20 months, offering an estimated annualized return of 8-10% and IRR 10-21% (depending on class) for equity investors.

Affordable Housing Single Family Fund

Our affordable housing single family projects are ground-up developments that will be retained as rental properties upon completion. These investments with an estimated IRR of 20%, annualized return 20% and 2X of equity for investors.

How To Invest

Tell Us About Yourself

Tell us more about yourself so we can better understand your goals.

Review Due Diligence Documents

Tell us more about yourself so we can better understand your goals.

Book a Call

Tell us more about yourself so we can better understand your goals.

Targeted Goals and Securities Disclaimer

Targeted refers to a goal that may or may not be attained based on a variety of assumptions that may or may not be realized. Securities are only available to verified accredited investors who can bear the loss of their investment.

No Offer of Securities; Disclosure of Interests

Under no circumstances should any material or information contained herein be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of a confidential offering memorandum relating to the particular investment.

Access to information about investments with projects undertaken by Countrywide Capital Group, LLC, Countrywide Housing Fund 1, LLC, or any of their respective affiliates is limited to investors who qualify as accredited investors within the meaning of the Securities Act of 1933, as amended. Investment outcomes vary. Past success does not guarantee future results. Historical return details are available.

No Offer of Investment, Legal, or Tax Advice

The material contained herein is general information for educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

Nothing contained in this material is intended to constitute legal, tax, securities, or investment advice, nor an opinion regarding the appropriateness of any investment. Prior to making any investment, you should consult with a licensed investment advisor, financial advisor, and legal and tax advisor.