Grow With Countrywide Capital Opportunity Zones

Discover growth potential with Countrywide Capital Opportunity Zones—your gateway to nationwide investment opportunities designed to maximize returns and impact communities across the country.

How Opportunity Zone Works?

Opportunity Zones provide tax incentives for investors to support economic development in designated low-income areas, aiming to boost long-term growth and community revitalization.

What Defines an Opportunity Fund?

An Opportunity Fund strategically invests in Opportunity Zones, providing tax incentives to investors. It focuses on projects in low-income areas to stimulate long-term growth.

Why Consider Opportunity Fund?

Opportunity Funds offer tax advantages and the chance to invest in underserved areas with growth potential. They provide a way to earn returns while contributing to revitalization.

THE BENEFITS FOR INVESTORS

When investors sell assets like real estate, stocks, or bonds, they typically realize a capital gain. By transferring these gains into an Opportunity Fund, they can take advantage of significant tax incentives. The following three reasons highlight why rolling your gain into an Opportunity Fund is beneficial:

Defer Your Tax Obligation

of your capital gains until DEC 31, 2026

Minimize Tax Liabilities

you owe by up to 15% after 7 years.

Enjoy Tax-Free Gains

on gains earned from an Opportunity Fund.

Countrywide Capital Opportunity Zone

Opportunity Zones, by Countrywide Capital, offer tax-advantaged investment opportunities in designated areas, promoting economic growth and community revitalization across the nation.

the lasting benefits of opportunity zone

Opportunity Zones provide enduring tax benefits and investment growth, supporting both investors and community revitalization.

How Wast Is The Opportunity?

Significant growth with impactful investment potential.

Total # of Opp Zones

of U.S Population

of U.S Tracts in List

Get to know countrywide capital opportunity zone

Discover how Countrywide Capital Opportunity Zones provide tax benefits while fostering growth in underdeveloped areas across the country.

The Problem

Through data analysis, we’ve discovered that the quality of Opportunity Zone projects varies widely, with many zones struggling due to insufficient income, population, or job opportunities to support new development.

Our Solution

Countrywide Capital’s Opportunity Zone Fund stands as the only true solution, using advanced demographic and real estate data analysis to uncover and secure top-tier investments for our clients.

How We Do It

We begin by analyzing demographics to focus on a select group of Opportunity Zones across the country. Our team then executes a specialized, zone-by-zone outreach campaign to identify standout projects.

Opprtunity Zone Investment types

There are three distinct investment types offered by fund companies: Houston self storage, palmeras-the villages and grand central suites.

Funds can choose between equity or debt investments. With an equity investment, you obtain an ownership interest in the underlying real estate. In contrast, with a debt investment, you act as a lender to the deal.

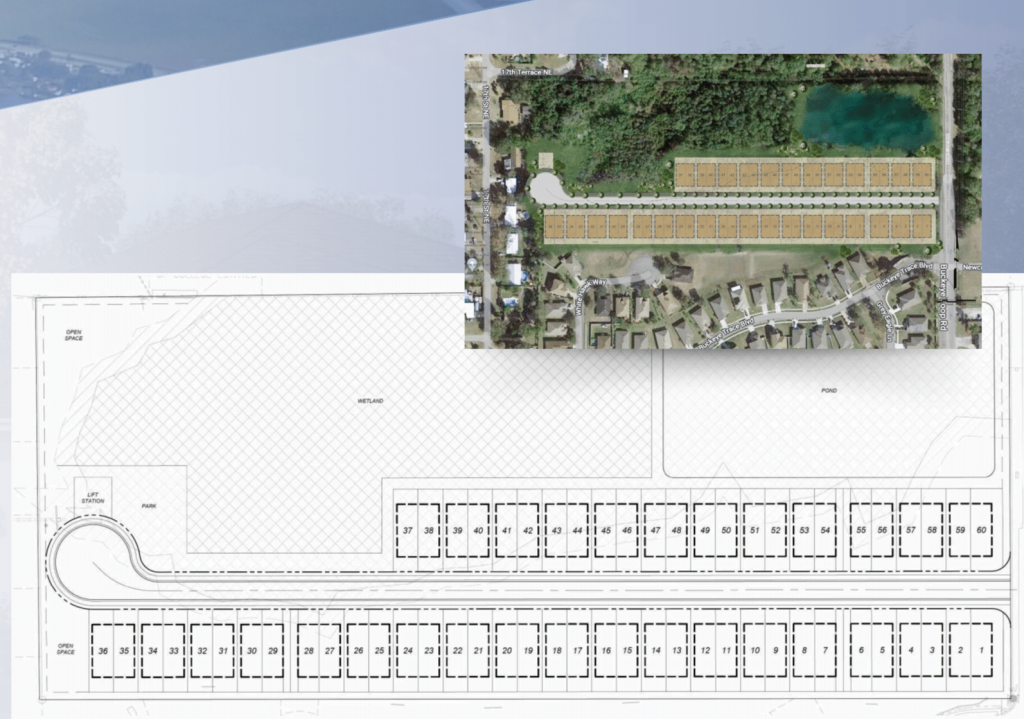

The Buckeye Oaks

A Built-to-Rent community in Winter Haven, Florida, featuring 30 duplex homes (60 units) across 16.1 acres. Each unit offers 3 bedrooms and 2 bathrooms, surrounded by lush green space. Designed for long-term value, it provides strong cash flow, appreciation, and tax benefits for investors.

Belleview Heights Apartments

Located in Belleview, Florida, this 166-unit workforce housing development spans 15.43 acres between The Villages and Ocala, two of Central Florida’s fastest-growing hubs. Fully entitled and zoned B2 Multifamily, with underground utilities and a lift station completed, it’s perfectly positioned for rapid development and strong early investor returns.

West Village Leesburg

A 31-acre townhome community in Leesburg, Florida, featuring 236 luxury townhomes between The Villages® and Metro Orlando. Designed for attainable luxury living, the project follows a 36-month build-for-sale strategy with strong investor returns.

Calculate Your Tax-Adjusted Returns

Calculate your tax-adjusted returns to understand the true profitability of your investments after accounting for tax obligations.

Understand Opportunity Zones Better

Gain a clearer understanding of Opportunity Zones and how they offer unique investment benefits and tax incentives.

Opportunity Zone Benefits

Opportunity Zones are a powerful economic development tool that incentivize investment in up-and-coming communities. Their primary purpose is to spur economic growth, create jobs, and provide significant tax benefits for investors.

The Investor’s Quick Guide to Real Estate Financing Options

Real estate investment offers incredible opportunities, but the journey from acquiring a property to generating rental income begins with choosing the right financing strategy.Understanding the principles, challenges…….

Opportunity Zones vs. 1031 Exchange Comparison

Opportunity Zones and 1031 Exchanges both offer tax advantages, but each has unique benefits. Knowing their differences can guide your investment decisions for maximum tax savings.

Unlock An Exciting New tax beniefit investment

Unlock a new investment opportunity that offers significant tax benefits and growth potential. This tax-advantaged option is designed to help you maximize returns while minimizing tax liabilities.

investor testimonials and feedback

Unlock a new investment opportunity that offers significant tax benefits and growth potential. This tax-advantaged option is designed to help you maximize returns while minimizing tax liabilities.

4.9

avg. clients ratings

Targeted Goals and Securities Disclaimer

Targeted refers to a goal that may or may not be attained based on a variety of assumptions that may or may not be realized. Securities are only available to verified accredited investors who can bear the loss of their investment.

No Offer of Securities; Disclosure of Interests

Under no circumstances should any material or information contained herein be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of a confidential offering memorandum relating to the particular investment.

Access to information about investments with projects undertaken by Countrywide Capital Group, LLC, Countrywide Housing Fund 1, LLC, or any of their respective affiliates is limited to investors who qualify as accredited investors within the meaning of the Securities Act of 1933, as amended. Investment outcomes vary. Past success does not guarantee future results. Historical return details are available.

No Offer of Investment, Legal, or Tax Advice

The material contained herein is general information for educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

Nothing contained in this material is intended to constitute legal, tax, securities, or investment advice, nor an opinion regarding the appropriateness of any investment. Prior to making any investment, you should consult with a licensed investment advisor, financial advisor, and legal and tax advisor.