CCG Heritage Fund

The Heritage Real Estate Investment Fund was specifically designed to provide owners of commercial real estate the option to dispose of their property while benefiting from an investment in a professionally managed, diversified real estate fund. Owners may contribute their property via a tax deferred transaction in exchange for units in the fund. Additional benefits are explained below.

Targeted Equity

Targeted IRR Pre-Tax Return

Targeted Asset Value

Targeted Investments

Why Contribute Real Estate Property to the Heritage Fund?

Contributing real estate to a heritage fund offers tax benefits, long-term asset growth, and a way to preserve wealth for future generations. It ensures your property supports meaningful causes, reduces maintenance burdens, and leaves a lasting impact aligned with your values.

Passive Ownership

Avoid the day-to-day management concerns of being a landlord and rely on the proven and experienced investment and property management of CCG Capital and our affiliates.

Tax-Deferred & Efficient

Contribute assets to the Heritage Fund, likely without recognizing capital gains. Contributors may also benefit from the depreciation of new assets acquired by the Heritage Fund, potentially reducing income taxes.

Diversification & Risk Reduction

Avoid the challenges of selling appreciated assets through a 1031 exchange and trading into inferior assets due to timing constraints. Instead, choose a 1031 exchange alternative and achieve diversification in a fund that targets acquisitions across multiple property types and markets.

Membership & Estate Flexibility

Provide maximum flexibility for family members or partnerships with different objectives. Heirs and partners are able to hold or redeem units based on their individual needs.

Private Real Estate vs. Public Markets

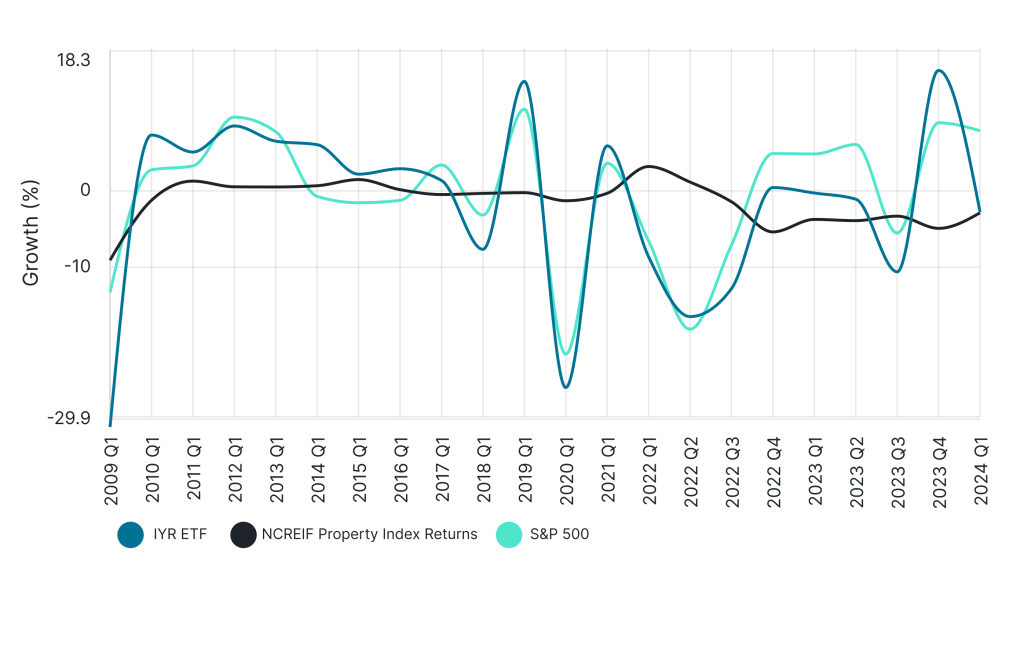

See below for a comparison of the S&P 500 (public equities index), IYR ETF (public REIT index), and NCREIF (private real estate) over the last 20+ years. Alternative investments, such as private real estate funds have performed steadily relative to the volatility of the public markets.

Heritage Fund Advantages Compared to Other Tax-Deferred Solutions

Possible alternative solutions to the Heritage Fund include receiving operating partner units of an UPREIT or selling and finding replacement property in a 1031 exchange, Delaware Statutory Trust, or TIC structure.

Common shortfalls of other tax-deferred exit strategies:

- Often subject to public market volatility

- Likely high fees and limited appreciation potential

- 1031 execution risk and single asset risk

- Possible corporate governance issues

The Difference Maker

The Heritage Real Estate Investment Fund was built to address many of the challenges faced by common alternative solutions.

Flexibility

Our structure considers your individual needs and timelines. Not bound to 45 or 180-day deadlines.

A Permanent Solution

The Heritage Fund is an evergreen fund, providing investors with a long-term solution.

Expertly Managed

Avoid day-to-day management concerns of being a landlord. CCG Capital has over three decades of investment and property management experience.

Vertical Integration

CCG structure allows it to control the process of owning, managing, leasing and selling real estate.

National Platform with Local Expertise

The Heritage Fund targets contributions in all U.S. markets, mainly sourcing multifamily, residential redevelopment properties and self storage, with an opportunistic view on ground up development. The Fund seeks to obtain long-term fixed-rate financing at a conservative leverage point, ensuring preservation of wealth for our investors while providing consistent cash flow and equity appreciation.

Connect with Us

Get Started

We seek appreciated real estate nationwide. Contribute your property to the Heritage Fund today.

Learn More

Take some time to dive into the details about private real estate, the Heritage Fund, and CCG Capital.

Targeted Goals and Securities Disclaimer

Targeted refers to a goal that may or may not be attained based on a variety of assumptions that may or may not be realized. Securities are only available to verified accredited investors who can bear the loss of their investment.

No Offer of Securities; Disclosure of Interests

Under no circumstances should any material or information contained herein be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of a confidential offering memorandum relating to the particular investment.

Access to information about investments with projects undertaken by Countrywide Capital Group, LLC, Countrywide Housing Fund 1, LLC, or any of their respective affiliates is limited to investors who qualify as accredited investors within the meaning of the Securities Act of 1933, as amended. Investment outcomes vary. Past success does not guarantee future results. Historical return details are available.

No Offer of Investment, Legal, or Tax Advice

The material contained herein is general information for educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

Nothing contained in this material is intended to constitute legal, tax, securities, or investment advice, nor an opinion regarding the appropriateness of any investment. Prior to making any investment, you should consult with a licensed investment advisor, financial advisor, and legal and tax advisor.