Multi Family

Countrywide Multi-Family

Countrywide Capital Group, LLC (CCG) seeks to acquire well-located multifamily assets in select markets, primarily in the southeast and adjacent regions, with particular emphasis on the Florida, California, Dallas/Fort Worth, Virginia, North Carolina, Atlanta, and other major markets in the Texas and DC/Baltimore markets. The desired investment includes Class A, B quality in B+ or better locations. We will consider garden, mid-rise and high-rise communities, as well as assets that can benefit from renovation and repositioning.

Regions:

- Florida

- Texas – Dallas/Fort Worth, San Antonio, Houston, Austin

- California

- Washington, DC/Baltimore

- Virginia – northern Virginia, Richmond, Tidewater, Charlottesville

- North Carolina – Charlotte, Raleigh, Greensboro, Wilmington

- South Carolina

- Georgia

- Tennessee

Category: Class A or B communities. Rehab and repositioning properties considered.

Size: 150 units or larger.

Terms: Typically all cash, but will consider assumption of existing financing or seller financing.

Submittal Information:

- Location map and area description

- Aerial photograph of site and vicinity

- Complete property description

- Color photographs

- Current tax bill

- Three years operating statements plus current YTD

- Current and past three months rent rolls (including concessions and delinquencies)

- Terms of financing (if assumable) including any prepayment provisions

- Detailed market data (include sales and rent comps)

- Capital improvements listing for the last five years

CCG Multi-Family Investment

Explore exceptional multifamily investment opportunities with Countrywide Capital Group, your trusted partner in the US real estate market. We specialize in identifying and securing high-potential properties that deliver strong returns, all while providing personal attention and unmatched results. Whether you’re an experienced investor or just starting, our expertise ensures your investment journey is seamless and successful. Choose Countrywide Capital Group for strategic guidance and a commitment to helping you achieve your financial goals.

Lake Willie Village

Lake Willie Village is a prime multifamily investment by Countrywide Capital Group, offering serene lakeside living, modern amenities, and strong returns—perfect for families, professionals, and retirees.

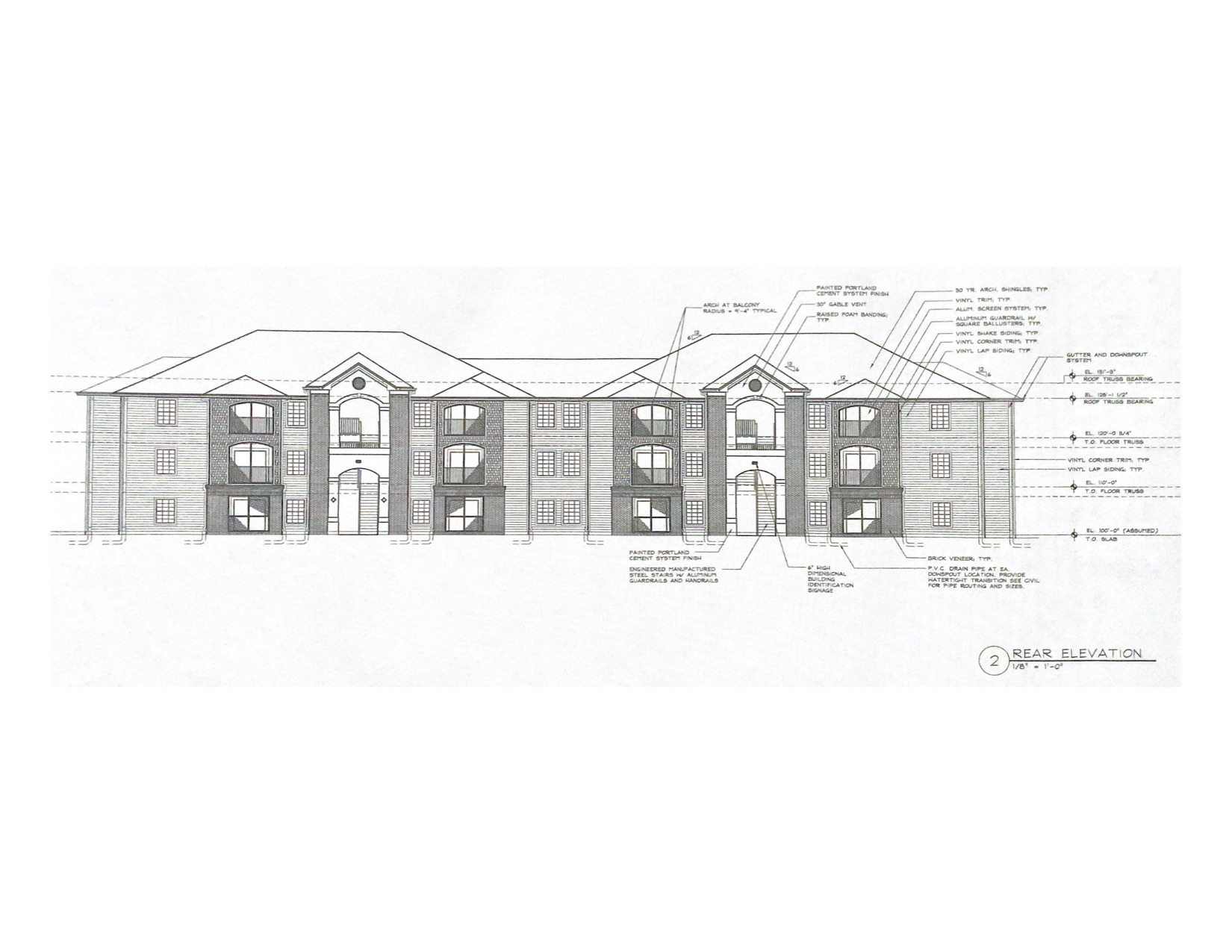

Magnolia Landing

Magnolia Landing is an exceptional multifamily investment opportunity from Countrywide Capital Group, offering modern living, natural charm, and strong growth potential in a highly desirable community.

Belleview Heights

Belleview Heights is a premier multifamily investment by Countrywide Capital Group, blending modern living with timeless charm in a sought-after community, offering excellent growth potential.

Grand Central Suites

Grand Central Suites is a luxury multifamily investment opportunity by Countrywide Capital Group, offering upscale living in a prime location with exceptional growth and income potential.

Why Multifamily?

The multifamily real estate asset class provides stable, non-correlated returns to help your clients achieve optimal portfolio diversification. Multifamily properties have consistently demonstrated lower risk and higher returns than other property types and have a low correlation to equities, bonds, and other alternative asset classes.

The bubble sizes in the corresponding chart represent the Sharpe Ratio, a measure of return per unit of risk, for each property type. The data’s source is the National Council of Real Estate Investment Fiduciaries (NCREIF) Property Index and represents the average annualized return over each five-year period from 1/1/1990 to 12/31/2023. Returns are unlevered.

Why Invest in Multifamily Real Estate?

Strong Returns

Private multifamily investments have historically outperformed bonds, public REITs, and even the S&P 500 when you review average annual returns since 2000.

Greater Stability

Because housing is a basic human need, multifamily has historically been more resilient than other investments during times of economic uncertainty, especially when comparing private multifamily developments to the volatility of public assets like stocks and REITs.

Tax Benefits

Real estate owners and limited-partnership investors can often capture unique tax advantages, particularly when investing in programs such as Opportunity Zones.

Diversification

Incorporating a mix of liquid and longer-term investments across multiple asset types can help insulate investors from downward-trending economic conditions — and prime market conditions can lead to incredible multifamily returns.

Call Us

407-401-8790

robert@myreocountrywide.com

Targeted Goals and Securities Disclaimer

Targeted refers to a goal that may or may not be attained based on a variety of assumptions that may or may not be realized. Securities are only available to verified accredited investors who can bear the loss of their investment.

No Offer of Securities; Disclosure of Interests

Under no circumstances should any material or information contained herein be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of a confidential offering memorandum relating to the particular investment.

Access to information about investments with projects undertaken by Countrywide Capital Group, LLC, Countrywide Housing Fund 1, LLC, or any of their respective affiliates is limited to investors who qualify as accredited investors within the meaning of the Securities Act of 1933, as amended. Investment outcomes vary. Past success does not guarantee future results. Historical return details are available.

No Offer of Investment, Legal, or Tax Advice

The material contained herein is general information for educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

Nothing contained in this material is intended to constitute legal, tax, securities, or investment advice, nor an opinion regarding the appropriateness of any investment. Prior to making any investment, you should consult with a licensed investment advisor, financial advisor, and legal and tax advisor.