Countrywide Capital Multi-Family Fund

Countrywide Capital Multi-Family Fund

The Countrywide Capital Multi-Family Fund provides a smart investment in high-demand rental properties. With stable income, growth potential, and expert management, it offers strong returns and portfolio diversification backed by our real estate expertise.

Why invest with US?

Countrywide is not like any other real estate company you’ve ever worked with. Countrywide Capital Group is a, debt–free and privately owned operator of residential and commercial real estate services throughout the Eastern United States.

15-20%

Targeted Internal Rate of Return

15-20%

Annual Cash-on-Cash Return

19.7%

Average Net IRR to the Investor

Why Invest in Multifamily Real Estate?

Multifamily real estate is a highly attractive investment option for accredited investors, offering a range of appealing fundamental qualities. Its consistent demand, potential for stable cash flow, and resilience during economic fluctuations make it a strong choice for those seeking reliable and profitable investment opportunities.

There are several reasons why it makes good sense for funds to invest in Countrywide Capital real estate projects, including:

Strong Returns

Strong Returns

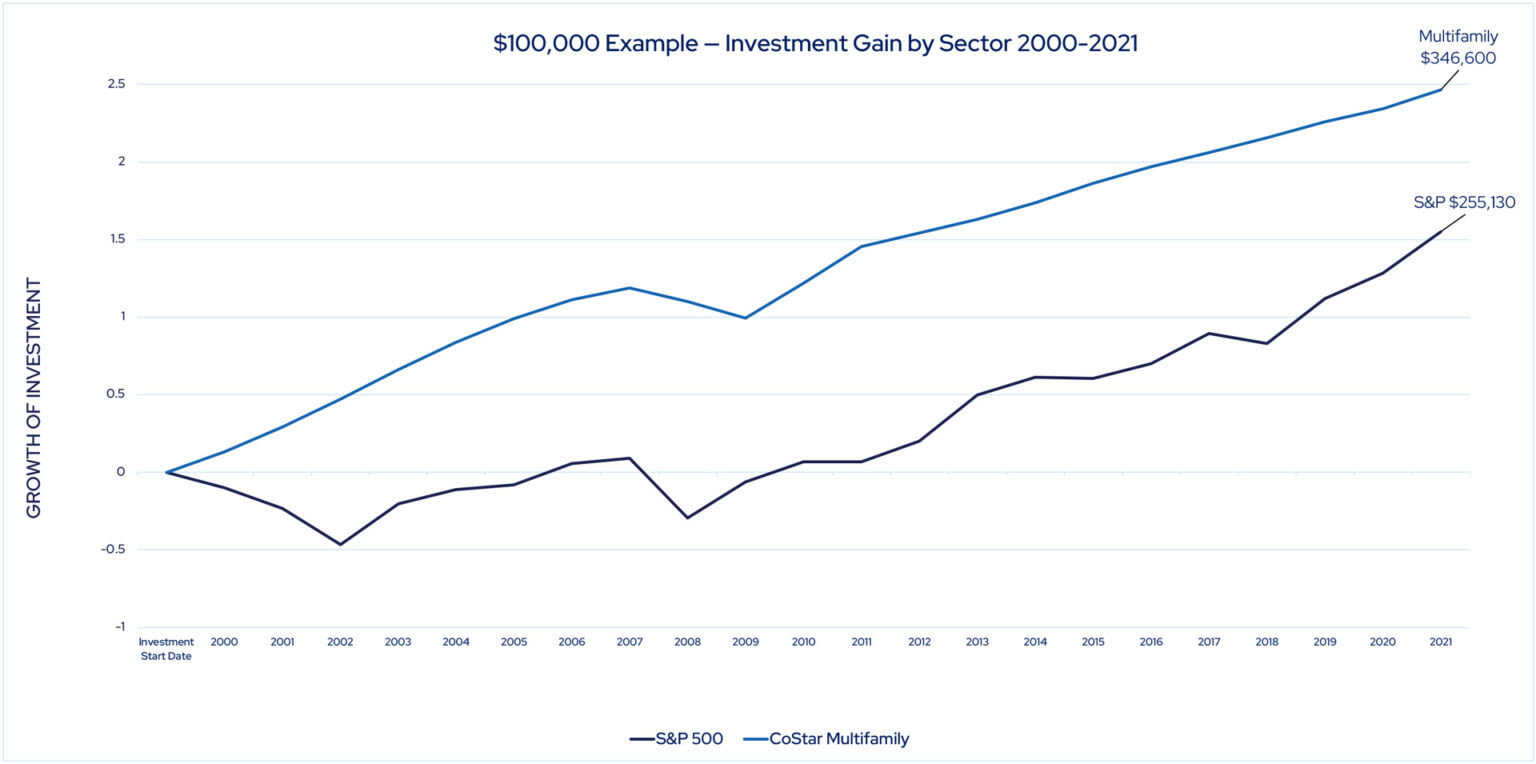

Private multifamily investments have historically outperformed bonds, public REITs, and even the S&P 500 when you review average annual returns since 2000.

Tax Benefits

Tax Benefits

Real estate owners and limited-partnership investors can often capture unique tax advantages, particularly when investing in programs such as Opportunity Zones.

Greater Stability

Greater Stability

Because housing is a basic human need, multifamily has historically been more resilient than other investments during times of economic uncertainty, especially when comparing private multifamily developments to the volatility of public assets like stocks and REITs.

Diversification

Diversification

Incorporating a mix of liquid and longer-term investments across multiple asset types can help insulate investors from downward-trending economic conditions — and prime market conditions can lead to incredible multifamily returns.

By The Numbers

Units built & under construction

Developed since 2012

Private equity raised

Multi-Family Investment Opportunities

Investment types

There are four distinct investment types offered by fund companies: Lake Willie Village, magnolia landing, belleview heights and grand central suites.

Funds can choose between equity or debt investments. With an equity investment, you obtain an ownership interest in the underlying real estate. In contrast, with a debt investment, you act as a lender to the deal.

Multi-Family Lake Willie Village

These Lake willie village investments are designed for resale and can be completed within 2 years, offering an estimated target return of 17%-20% for equity investors.

Multi-Family Magnolia Landing

Magnolia Park is a rare opportunity to invest in a high-demand, high-profit senior living community in one of Florida’s fastest-growing regions. With zoning, utilities, and PACE funding already in place, this development is positioned for efficient execution and significant returns.

Multi-Family Belleview Heights

These opportunistic developments are designed for resale and can be completed within 14-20 months, offering an estimated annualized return of 8-10% and IRR 10-21% (depending on class) for equity investors.

How To Invest

Tell Us About Yourself

Tell us more about yourself so we can better understand your goals.

Review Due Diligence Documents

Tell us more about yourself so we can better understand your goals.

Book a Call

Tell us more about yourself so we can better understand your goals.

Targeted Goals and Securities Disclaimer

Targeted refers to a goal that may or may not be attained based on a variety of assumptions that may or may not be realized. Securities are only available to verified accredited investors who can bear the loss of their investment.

No Offer of Securities; Disclosure of Interests

Under no circumstances should any material or information contained herein be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of a confidential offering memorandum relating to the particular investment.

Access to information about investments with projects undertaken by Countrywide Capital Group, LLC, Countrywide Housing Fund 1, LLC, or any of their respective affiliates is limited to investors who qualify as accredited investors within the meaning of the Securities Act of 1933, as amended. Investment outcomes vary. Past success does not guarantee future results. Historical return details are available.

No Offer of Investment, Legal, or Tax Advice

The material contained herein is general information for educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

Nothing contained in this material is intended to constitute legal, tax, securities, or investment advice, nor an opinion regarding the appropriateness of any investment. Prior to making any investment, you should consult with a licensed investment advisor, financial advisor, and legal and tax advisor.