Recent economic headlines about inflation, rising interest rates, and bank instability have caused some investors to shy away from new opportunities, focusing instead on safer, more stable investments. However, opportunistic investors understand that now is not the time to retreat but rather to seek opportunities that offer a balance of stability and growth potential.

Multifamily real estate, in particular, continues to stand out as an asset class that balances risk and reward. Historical data shows that multifamily investments weather economic downturns better than other asset classes like stocks and bonds. For example:

- During the Great Recession of 2008, the multifamily sector returned 5.2%, while the S&P 500 index declined by 37% (NCREIF).

- During the COVID-19 pandemic in 2021, multifamily investments returned 18.9%, demonstrating resilience even as the broader economy faced uncertainty.

Why does multifamily real estate remain strong? Housing is essential—regardless of economic conditions, people will always need a place to live. Let’s explore the performance, stability, and advantages of multifamily real estate compared to other investments.

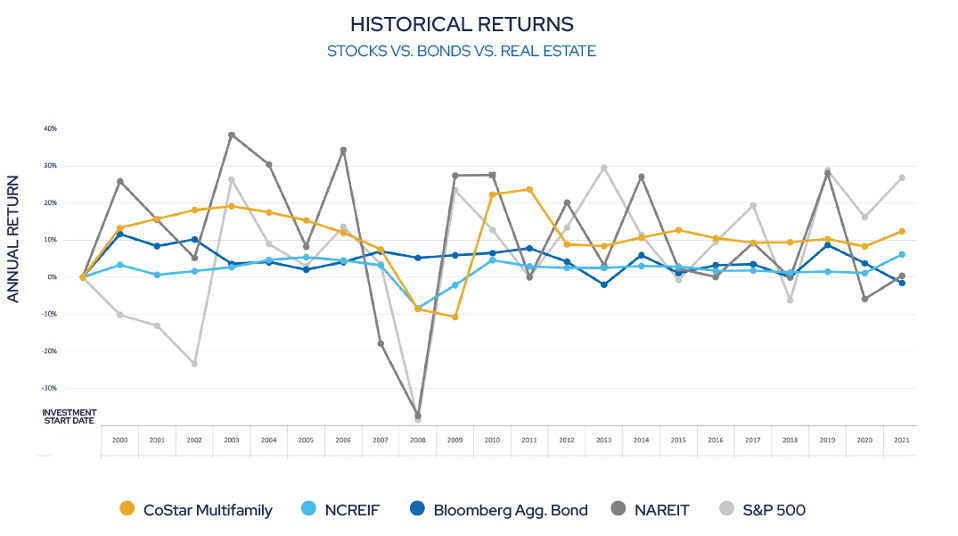

Volatility Comparison

Looking at annual returns since 2000 across stocks (S&P 500), bonds (Bloomberg Agg.), public real estate trusts (NAREIT), private commercial real estate (NCREIF), and multifamily real estate (CoStar Multifamily), we see that some asset classes are far more volatile than others.

- Stocks and REITs: While they offer high-return potential, both are traded on public exchanges and are extremely sensitive to economic shifts. This has led to severe downturns during periods like the Great Recession, wiping out significant gains.

- Bonds: Bonds are less volatile but offer lower returns, providing stability but not significant growth.

- Multifamily Real Estate: Multifamily investments provide a balance of stability and growth, with less volatility than stocks and REITs and better returns than bonds.

Multifamily real estate is not directly correlated with the stock market, insulating it from the sharp highs and lows that plague publicly traded assets.

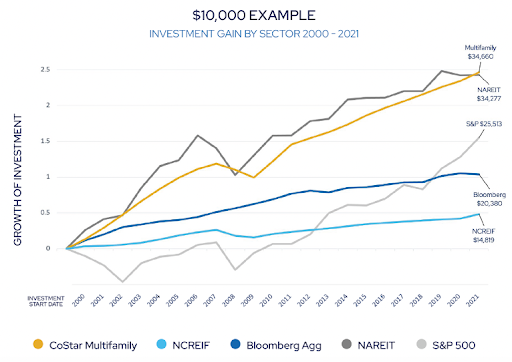

Performance Comparison

If you had invested $10,000 in the year 2000, here’s how your investment would have grown across asset classes:

- Multifamily Real Estate: $34,660

- Public REITs: $34,277

- S&P 500 Stocks: $25,513

- Bonds: $20,380

Multifamily real estate offers the highest long-term gain, with less volatility than REITs or stocks and significantly stronger returns than bonds. For investors seeking a balance of growth and security, multifamily real estate is the standout choice.

Multifamily vs. Other Real Estate Investments

Multifamily real estate offers key advantages over other real estate sectors:

- Commercial Properties (Office, Retail, Industrial)

- Volatility: More susceptible to economic downturns.

- Challenges: Office properties face occupancy challenges post-pandemic, while retail properties continue to struggle with shifting consumer habits.

- Costs: Industrial properties are often more expensive to acquire and maintain.

- Single-Family Rentals

- Vacancy Risk: A single move-out results in 100% vacancy.

- Management Burden: Requires significant time investment for self-management.

- Multifamily Properties

- Steady Demand: Multifamily properties fulfill an essential need, making them less cyclical.

- Income Consistency: Generate steady income streams without the operational burden of self-management.

- Liquidity: Multifamily investments offer more liquidity than other real estate sectors.

Why Multifamily is the Sweet Spot

Key takeaways for multifamily real estate investing:

- Stability and Growth: Multifamily balances risk and reward, with less volatility than stocks or REITs and better returns than bonds.

- Resiliency: Compared to other real estate investments, multifamily properties are less impacted by economic downturns and provide consistent income.

- High Demand: Housing remains a fundamental need, driving steady demand even in uncertain markets.

Why Countrywide?

At Countrywide, we believe multifamily properties are one of the most compelling investment options in today’s economy. Our team has a proven track record of developing and managing high-quality multifamily properties that deliver stable returns and significant growth potential.

We combine decades of expertise with a vertically integrated approach—overseeing every step of the process from development to asset management. This approach ensures cost efficiencies, optimized performance, and long-term success for our investors.

If you’re interested in learning more about multifamily investing and how it can help you achieve your financial goals, contact Countrywide today. We’re here to guide you toward opportunities that balance risk and reward in a way few other investments can.