Opportunity Zones are a powerful economic development tool that incentivize investment in up-and-coming communities. Their primary purpose is to spur economic growth, create jobs, and provide significant tax benefits for investors. At Countrywide, we specialize in leveraging these benefits to generate exceptional returns for our investors while contributing to community development.

Tax Incentives for Opportunity Zone Investors

When investing in a Qualified Opportunity Fund (QOF), investors can take advantage of two major tax benefits:

- Deferral of Capital Gains

Capital gains generated from a sale can be deferred until December 31, 2026 by reinvesting the gain in a QOF. Examples of eligible capital gains include:- Sale of a business

- Stock sales

- Real estate sales

- Tax-Free Gain

If an Opportunity Zone (OZ) project is held for a minimum of 10 years, the appreciation and gains on the project become completely tax-free. This creates an unparalleled opportunity for long-term investors.

Investor Requirements

To qualify for these tax incentives, investors must adhere to specific timelines:

- 180-Day Investment Window: Investors have 180 days to reinvest the gain in a QOF.

- Individual Investors: The clock starts from the date of the sale that generated the gain.

- Pass-Through Entities: If the gain flows through a Partnership, S Corporation, RIC, or REIT, the 180-day period starts from the tax year-end of the entity.

- Election Option: Taxpayers may also elect to begin the 180-day period on the due date of the entity’s tax return (e.g., March 15 for calendar-year partnerships/S-corporations).

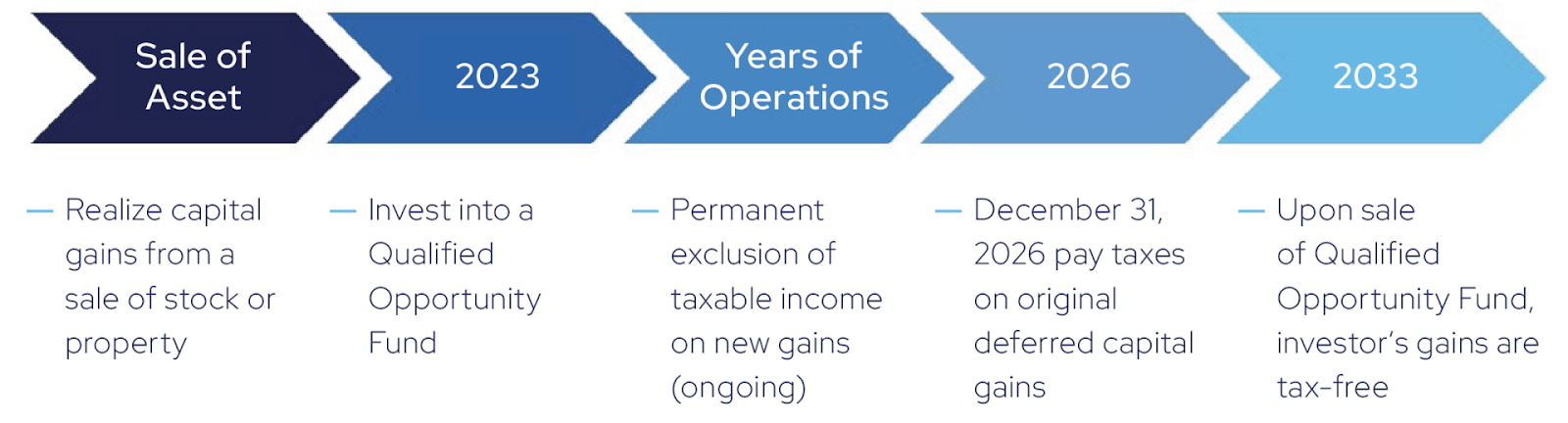

Opportunity Zone Investment Timeline Example

Additional Tax Benefits of Opportunity Zone Projects

Opportunity Zone investments offer additional tax benefits beyond deferring and eliminating capital gains:

- Significant Depreciation Deductions:

- Depreciation deductions typically equal 100% or more of an investor’s cash investment within the first five years after the building is placed in service.

- Over the depreciable life of the building (30 years), deductions can be as much as 3X the investor’s cash investment.

- Offsetting Income with Depreciation:

- Losses generated by depreciation can shelter other sources of pass-through income annually.

- Any unused losses can be carried forward to future tax years.

- No Depreciation Recapture:

Unlike other real estate projects, Opportunity Zone investors do not need to recapture depreciation as additional gains upon sale if the property is held for 10 years. This creates significant long-term tax savings.

Summary

Investing in Opportunity Zones offers unparalleled tax advantages:

- Deferral of capital gains until 2026.

- Complete tax-free gains on appreciation after 10 years.

- Significant depreciation deductions that shelter other income.

By investing in up-and-coming Opportunity Zones, investors can achieve strong financial returns while making a positive impact on communities.

Important Disclaimer

No Offer of Securities: This material is for informational purposes only and should not be considered an offer to sell or a solicitation to buy an interest in any investment. Any such offer or solicitation will be made only through a confidential Private Placement Memorandum. Access to information about investments with Countrywide is limited to accredited investors under the Securities Act of 1933 or those with the financial sophistication to evaluate the risks and merits of such investments. Investment outcomes vary, and past success does not guarantee future results. Historical return details are available upon request.