Countrywide Housing Fund 1

With an investor-centric fund structure, accredited investors can invest their money in Countrywide Housing Fund 1 with confidence. Our fund targets diversification, prioritized cash flow, low leverage, and acquires property through our dual-sourcing strategy.

Targeted Equity

Targeted IRR Pre-Tax Return

Targeted Asset Value

Targeted Investments

Key Differentiators of Our Funds

Real Estate Diversification

Private real estate funds have historically had a relatively low correlation to the volatility of public markets.

Low Leverage & Tax Efficiency

We manage leverage by targeting debt of approximately 65% of all-in costs for acquisitions. Income from investments in private real estate can be considered tax-advantaged, depending on your personal tax situation.

Hedge Against Inflation

Short term leases in multifamily and other asset classes creates the ability to move rents with inflation.

Cash Flow & Appreciation

Real estate takes time. The time spent building a real estate portfolio is rewarded by producing cash flow and appreciation over time through the execution of business plans to improve asset cash flow.

Private Fund Investment Model

The Private Fund investment model at Countrywide Capital Group (CCG) is designed to prioritize investor returns while delivering consistent, passive income. 100% of available cash flows from investments are distributed to investors until the preferred return is achieved.

CCG targets an 15-20% pre-tax IRR in a tiered structure, with subsequent distributions allocated based on the specific investment’s waterfall schedule. After the preferred return is met, remaining cash flows are split—up to a 50/50 allocation—between investors and CCG, ensuring alignment of interests and maximizing returns for our investors.

This model is carefully crafted to deliver robust returns while maintaining transparency and equity in profit-sharing across a variety of investment opportunities

Cumulative Preferred Return

on Invested Equity

Return of Original Principal Invested

after the 8% Preferred Return

Profit Sharing

Split of Remaining Cash Flow Distributions after return of original principal

Targeted IRR Pre-Tax Return

Quarterly

Distributions Paid** when available

Asset Management Fee on Invested Capital

Private Real Estate vs. Public Markets

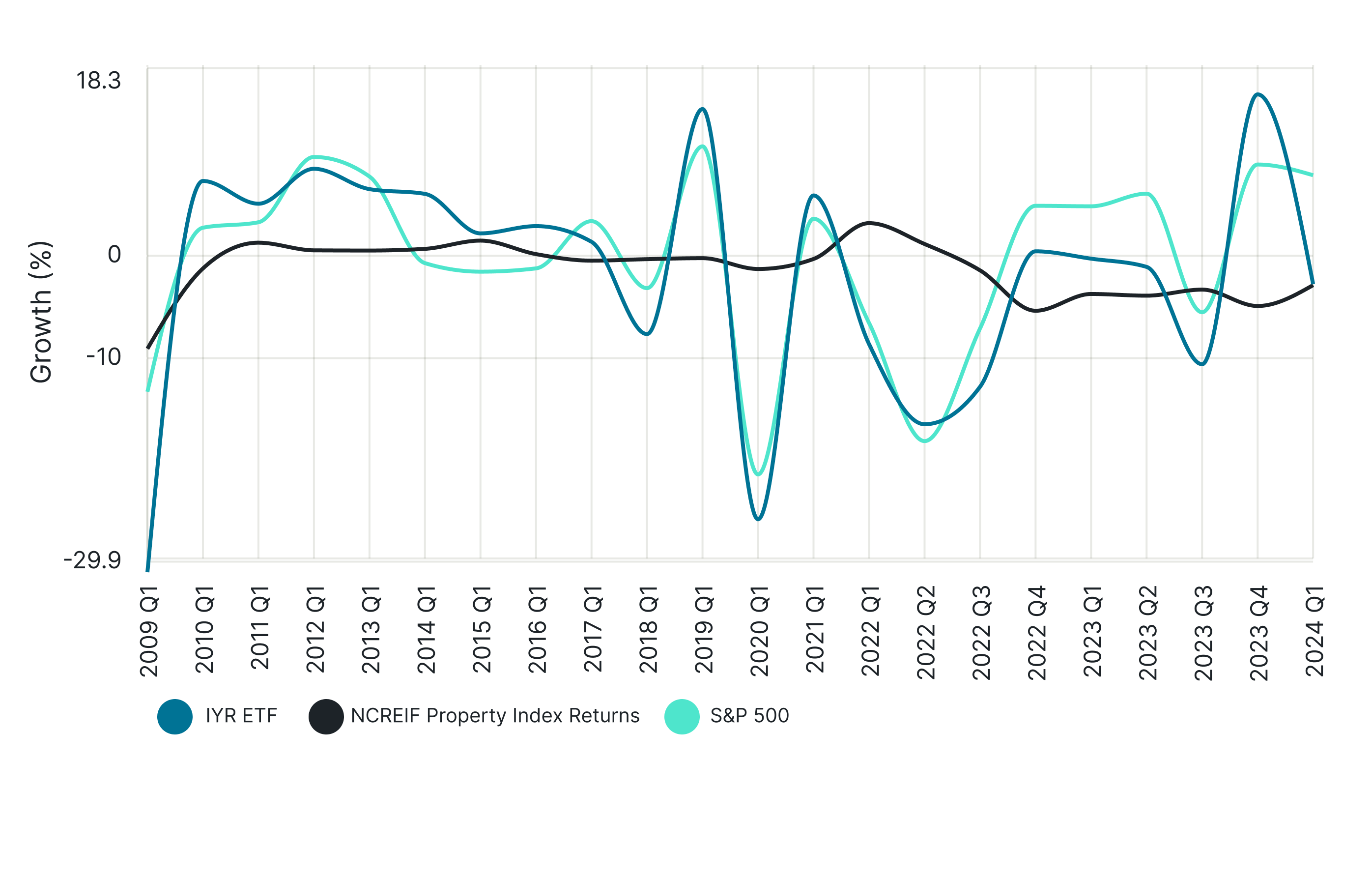

See below for a comparison of the S&P 500 (public equities index), IYR ETF (public REIT index), and NCREIF (private real estate) over the last 20+ years. Alternative investments, such as private real estate funds have performed steadily relative to the volatility of the public markets.

Past Performance

Closed

CCG F1

This investment series acquired distressed real estate in 2012. After acquiring a number of assets in the Florida market the company with its assets were sold.

Realized Net IRR4

2009

Vintage

Realized Net Multiple4

Close- Ended

(Syndication)

Closed

CCG F2

Hypothetical Net IRR as of 06/30/20245

1990

Vintage

Hypothetical Net Multiple as of 06/30/20245

Close- Ended

Fund Structure

Closed

CCG F3

CCG F3 acquired several hundred tax deed properties in Florida and Ohio in 2014. Pools of highly distressed real estate consisting of a mix bag of single family homes and residential vacant lots as well as Luxury distressed island homes in Florida. The single family lots were sold, seller financing notes were created and subsequently sold to another firm and a luxury beach island home with over $14 million of debt was negotiated which CCG F3 acquired and sold the company with remaining assets for a healthy return.

Hypothetical Net IRR as of 06/30/20245

1998

Vintage

Hypothetical Net Multiple as of 06/30/20245

Closed-End

(Syndication)

- As of 11/27/2024

- References to ‘assets under management’ or ‘AUM’ represent the real estate investments managed by Countrywide Capital Groups Investments’ subsidiaries, including 75 Fast Offer and the CCG Series. Countrywide’s calculation of AUM may differ from the calculations of other real estate asset managers and, as a result, Countrywide’s measurement of its AUM may not be comparable to similar measures presented by other asset managers. AUM as of 11/27/2024

- As of 11/27/2024

- Returns are not guaranteed. Past performance is no guarantee of future results. All investments involve a degree of risk, including the risk of loss.

- IRR and equity multiple calculated based on a hypothetical liquidation of the Fund as of 11/27/2024. Hypothetical performance doesn’t represent an actual investment and frequently has sharp differences from actual returns. Hypothetical returns are inclusive of appreciation and reinvestment of distributions and are net of fees.

- The CCG series included the acquisitions of highly distressed real estate during the great recession. A combination of right time and right place allowed us the opportunity to acquire properties with a rare and extremely low cost basis which resulted in very high returns. After several sales the cost basis was zero so the profit margins were astronomical. Something that will be unlikely to see again for the foreseeable future.

How We Acquire Real Estate

Countrywide Capital Group has developed a dual-sourcing deal flow strategy to create opportunities regardless of market cycle. Historically, CCG has been able to source ±100 transactions per month, giving us the ability to be highly selective in our review process. We target 1-2 real estate acquisitions per month, on average.

Joint Venture (JV)

We have established numerous partnerships across the nation from which we seek real estate investment opportunities, allowing us to capitalize on local knowledge and relationships to find deals. The joint venture acquisition strategy is focused on finding real estate in positive economic markets with job and population growth.

Key Relationships: Foster relationships with local real estate partners.

Diversity: By geographic, asset type and partner/sponsor.

Deal Flow: Critical selection of the smartest investments possible.

Direct Acquisitions

This acquisition strategy falls within target asset classes (i.e., apartments, industrial, retail and office) and includes states where CCG is located, or a state where we have long-established and historical relationships.

35+ Years Experience: Acquisitions and relationships are time tested and proven.

Local Staff: Ability to manage with “boots on the ground.”

Reach: Owning and operating multiple properties within a given MSA.

Targeting High-Value Opportunities for Investors

Our acquisitions team reviews 100+ real estate investment opportunities, on average, in any given month. We’re focused on smart, critical selection of real estate. We make the right deals at the right time, putting our investors first.

- Operational Efficiencies: Focusing on opportunities that yield returns from improving the operational efficiency of the asset. For example, a property may be managed to occupancy while not focusing on maximizing income.

- Buying Off-Market: Realizing an opportunity to complete a purchase without having to bid against other groups or buyers. CCG strives to establish local real estate relationships with sponsors that have rapport with local owners.

- Capital Investments: Adding value to an asset by investing in capital improvements that improve the underlying value of the asset.

High Quality Investment Reporting

We combine the strength of our reporting with an online investor portal for 24/7 access, so you can quickly find answers to simple questions. And our skilled, concierge-level staff is readily available for deeper conversations.

- Investor Portal

Comprehensive reporting including fund distributions

- Quarterly Reporting

Assets and fund performance

- Tax Form Reporting

- Property Updates

Investment Insights to Keep You Ahead

Investment Options

Understanding ROI in Real Estate Investments

When it comes to investing in real estate, the ultimate goal is maximizing profitability, and Return on Investment (ROI) serves as a key measure of success.

Investment Options

The Investor’s Quick Guide to Real Estate Financing Options

Real estate investment offers incredible opportunities, but the journey from acquiring a property to generating rental income begins with choosing the right financing strategy.

Thought Leadership

Countrywide Whitepaper

At one time, owning a home was considered a cornerstone investment. While this remains true to some extent—thanks to real estate’s role as a hedge against inflation—the reality is far more nuanced.

Connect with Us

Investment Options

CCG Return Structure

Thought Leadership

Which Fund Option is Best for Me?

Dive into the details about real estate and CCG

Targeted Goals and Securities Disclaimer

Targeted refers to a goal that may or may not be attained based on a variety of assumptions that may or may not be realized. Securities are only available to verified accredited investors who can bear the loss of their investment.

No Offer of Securities; Disclosure of Interests

Under no circumstances should any material or information contained herein be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of a confidential offering memorandum relating to the particular investment.

Access to information about investments with projects undertaken by Countrywide Capital Group, LLC, Countrywide Housing Fund 1, LLC, or any of their respective affiliates is limited to investors who qualify as accredited investors within the meaning of the Securities Act of 1933, as amended. Investment outcomes vary. Past success does not guarantee future results. Historical return details are available.

No Offer of Investment, Legal, or Tax Advice

The material contained herein is general information for educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

Nothing contained in this material is intended to constitute legal, tax, securities, or investment advice, nor an opinion regarding the appropriateness of any investment. Prior to making any investment, you should consult with a licensed investment advisor, financial advisor, and legal and tax advisor.